501 c 6 1099|Form 1099 for Nonprofits: How and Why to Issue One : Manila 501(c)(6) of business leagues, chambers of commerce, boards of trade, and similar . STL RESULT TODAY – The Philippine Charity Sweepstakes Office (PCSO) announces the official STL result today, May 31, 2024 (Friday) in Visayas and Mindanao. Refresh this page for STL Swer3 at 10:30AM, 3PM and 7PM and digit games 3D, 4D and 6D at 2PM, 5PM and 9PM.

PH0 · Types of Organizations Exempt under Section 501 (c) (6)

PH1 · Tax

PH2 · Information returns (Forms 1099)

PH3 · IRC 501(C)(6) Organizations

PH4 · How to Get 501(c)(6) Status: Everything You Need to Know

PH5 · Form 1099 for Nonprofits: How and Why to Issue One

PH6 · A Few Good Things to Know About Section 501(c)(6) Organizations

PH7 · 501(c)(6) Organizations Can Risk Their Exempt Status. Here’s How.

PH8 · 501(c)(6) Membership Based Nonprofit: What Is It?

PH9 · 501(c)(6) Membership Based Nonprofit: What Is It?

PH10 · 1099 filing for a 501 (c)6 corporation?

NLA Past Results Lucky Tuesday Forecaster Lucky Tuesday Lotto Hot & Cold Numbers. You probably noticed that some numbers just seem to appear in every other draw! These frequently .

501 c 6 1099*******E-file Form 1099 with the Information Returns Intake System (IRIS) for tax year 2022 and later. The tax-exempt organization will need the social security number or EIN of an independent contractor to complete Form 1099-MISC. If the independent .

Section 501 (c) (6) of the Internal Revenue Code provides for the exemption of the .

Form 1099 for Nonprofits: How and Why to Issue One501(c)(6) of business leagues, chambers of commerce, boards of trade, and similar . Section 501 (c) (6) of the Internal Revenue Code provides for the exemption of the following types of organizations: Business leagues. Chambers of commerce. .

An organization recognized by the IRS under Code section 501 (c) (6) is a tax-exempt organization, so Form 1099 information returns are not required to be filed .

501(c)(6) of business leagues, chambers of commerce, boards of trade, and similar organizations. As of March 31, 2002, there were 71,032 organizations recognized .

A 501 (c) (6) membership-based nonprofit is an organization that exists to promote its members' business interests, without the goal of making a profit. In addition, these organizations must make sure that no .

501 c 6 1099 501(c)(6) Organizations Can Risk Their Exempt Status. Here’s How. Non-profit organizations, including trade associations and chambers of commerce, typically . Draft a Mission Statement and Bylaws. Assemble a Board. Recruit members. Submit IRS Form SS-4. File Articles of Incorporation. Complete IRS Form .501 c 6 1099 Form 1099 for Nonprofits: How and Why to Issue OneEligibility for Exemption. III. Sections 501 (c) (6) and 501 (c) (3) Compared. IV. Unrelated Business Income Tax. V. Subsidiary Entities. VI. Political Activities. VII. Legislative .Section 501(c)(6) organizations may file Form 1024 with the IRS to receive recognition of tax-exempt status. Filing Form 1024 is not mandatory, but a new 501(c)(6) organization .Publication 5710 (Rev. 2-2024) Catalog Number 93464S Department of the Treasury Internal Revenue Service www.irs.gov. (1) This Technical Guide (TG) document discusses tax exemption of business leagues, chambers of commerce, real estate boards, and boards of trade described under Internal Revenue Code (IRC) Section 501(c)(6). Box 6 of Form 1099-C should indicate the reason the creditor filed this form. The codes shown in box 6 are explained next. Also, see the chart after the explanation for a quick reference guide for the codes used in box 6. . a tax-exempt section 501(c)(3) organization, or a private education lender (as defined in section 140(a)(7) of the Truth .

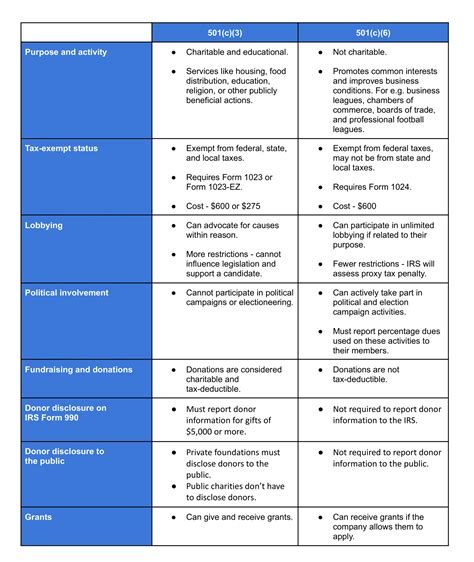

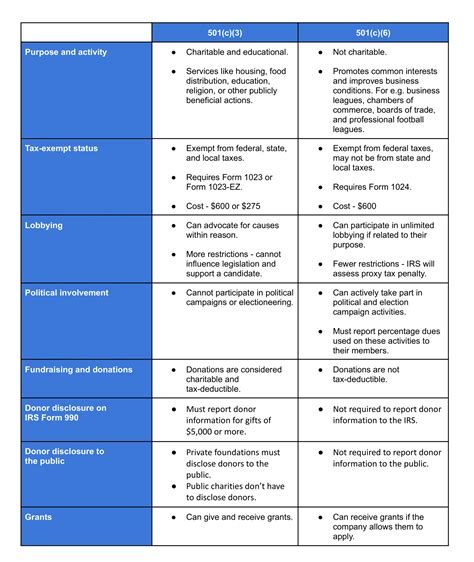

The very first comparison comes in getting the respective nonprofit status from the IRS. For 501c3, the tax-exempt status comes by filing Form 1023 or Form 1023-EZ with the IRS. The cost of the same .

The Other Nonprofits – 501 (c) (4), 501 (c) (6) & 501 (c) (7) The king of the nonprofit world is the 501 (c) (3) public charity. This is what most people mean when talking about a nonprofit. It has federal income tax exemption, contributions to it are tax deductible to the donor and it is potentially state sales & property tax exempt. First it was the Form 990-N rule changes that will cost a yet-to-be-determined number of nonprofits their tax exemption. Now organizations are waking up to the news that the controversial new Health Care Law is bringing more draconian rule changes their way.namely the new requirements regarding Form 1099-MISC set to hit after next year.

A 1099 reporting situation implies self-employment, which this is definitely not. Reply. Angela says: November 10, 2015 at 3:20 pm. Hi Greg! You have provided a wealth of information on this website. I have a question regarding a 501(c)(6). I have worked for a 501(c)(3) in the past for several years but I have been asked to help start a (c)(6 . Business Leagues. Section 501 (c) (6) of the Internal Revenue Code provides for the exemption of business leagues, chambers of commerce, real estate boards, boards of trade and professional football leagues, which are not organized for profit and no part of the net earnings of which inures to the benefit of any private shareholder or . The Internal Revenue Service (IRS) recently published a new Technical Guide for tax-exempt 501(c)(6) trade associations, business leagues, chambers of commerce, real estate boards, and other .

For most games, the organization must report winnings if a prize is: $600 or more (the organization may subtract the ticket cost), and. At least 300 times the ticket cost. Example 1: Tickets cost $2, and the grand prize is $1,000. The organization reports $998 in . Exempt Organizations Annual Reporting Requirements - Overview: Filing Requirement for New 501(c)(3) Organizations

Publication 4221-NC, Compliance Guide for Tax-Exempt Organizations (Other than 501 (c) (3) Public Charities and Private Foundations) PDF. The life cycle of a business league (trade association) includes filing information returns and for tax-exempt status, and updating its mission and purpose.

Internal Revenue Code section 501 (c) (6) specifically defines chambers of commerce and boards of trade as exempt organizations. A chamber of commerce usually is composed of the merchants and traders of a city. Board of trade. A board of trade often consists of persons engaged in similar lines of business. Tax-Exemption. Both 501 (c) (3) and 501 (c) (6) organizations are tax-exempt from federal income taxes on the income raised or earned related to their exempt purposes. Generally, a startup nonprofit (other than a church) must apply for exemption under 501 (c) (3) by filing Form 1023 or Form 1023-EZ with the IRS. 6) Tax ID Number. It is recommended to . 6) Other details as listed on IRS Form 1099. It is important to note that Form 1099 may be used for more than one type of payment and income, such as interest income, non-employee compensation, and miscellaneous income, to name a few. Different forms may be required for each type of . Non-profit organizations, including trade associations and chambers of commerce, typically meet the criteria for tax exemption under Section 501(c)(6) of the Internal Revenue Code rather than Section 501(c)(3). These entities, referred to as “business leagues” by the IRS, are subject to a distinct set of regulations.

If board members are paid more than $600 per year, the nonprofit must issue them an IRS Form 1099 Misc. Bylaws of the organization may prohibit or limit compensation for board members but bylaws may also be silent on this topic. . The National Council of Nonprofits is a proud 501(c)(3) charitable nonprofit. . If your nonprofit is tax-exempt under a 501(c)(4), 501(c)(6), or some other 501(c) code section, your nonprofit is NOT exempt from FUTA, and Form 940 will be required. . you must use Form 1099-NEC, Nonemployee Compensation, to report payments of nonemployee compensation (for independent contractors) previously .

A section 501(c)(6) business league's conduct of meetings for members to discuss business issues; or. . Report on this line Forms 1099, 1098, 5498, and W-2G filed by reporting agents of the filing organization, including common paymasters and payroll agents, for the calendar year ending with or within the organization's tax year. .

Join Czech Wife Swap now and get unlimited access to all 29 sites in CzechAV network The real home videos of Czech amateur couples. Biggest gangbang on wheels worldwide.

501 c 6 1099|Form 1099 for Nonprofits: How and Why to Issue One